ASHI NEWSROOM

INDUSTRY NEWS AND UPDATES FROM THE AMERICAN SOCIETY OF HOME INSPECTORS, INC.

Latest News & Articles

Search the Newsroom

Behind the Scenes

ASHI held its 48th annual meeting at the ASHI Virtual Summit on Friday, February 9. We were excited to have nearly 200 attendees in attendance for the second AVS. I want to update the membership briefly on what was presented for those who couldn’t make it.

By: Mark Goodman Member ExclusiveThings to Consider When Choosing a Job as a Home Inspector

In last month’s article, we explored four sets of cons and pros of choosing a new inspection career. In this second part of our pros and cons series, we’ll weigh four more things to consider when choosing a job as a new home inspector.

By: Stephanie Jaynes Member ExclusiveWhere Did the Volunteers Go?

There is much to learn by watching trend lines. Chapters are shrinking. The average age of ASHI members is increasing. Volunteers are less prevalent. What’s going on? It seems to me that we are experiencing a change of attitude and expectation.

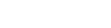

By: Hollis Brown Member ExclusiveInspection World On the Road

Leaders in the industry make final preparations for the St. Louis InspectionWorld on the Road events this September.

By: Laura Rote Member ExclusiveIn This Together

Atwell, who won ASHI’s 2023 Monahan Award, has been working since July 2022 to help pass legislation in Massachusetts to help protect home inspectors and homebuyers with the right to have a home inspection.

By: Laura Rote Member ExclusiveASHI Reporter this month

Alternative Sources of Inspection Income in Slow Times

O One must have faith to be a home inspector. We’re never really sure we have a job until we get to the site, the house is ready, the clients arrive, and the real estate agent gets us in. During this slowdown many of us have had to make drastic changes.